The Sobering Reality Of The AFL Trade Period

Last updated: Nov 11, 2020, 1:53AM | Published: Nov 10, 2020, 2:15AM

Imagine Trade Radio in 2008.

There was no shortage of drama, but only six footballers were traded to another club – a modest number that prompted the AFL Players’ Association to call for free agency.

Four years passed before the AFLPA’s wish became a reality and there were theories for the trading lull, but they’re merely footnotes here.

Just two of those six players, Rhyce Shaw and Farren Ray, played more than 67 games for their new club. Two others didn’t reach five. Let that sink in.

Shaw and Ray logged 143 and 130 senior matches, respectively, for Sydney and St Kilda despite costing those clubs only pick 46 and 31.

RELATED: Check out Stats Insider's Own Player Ratings and DNA visualisations

They’re the sorts of elusive bargains that list bosses hunt for each October (or November in 2020).

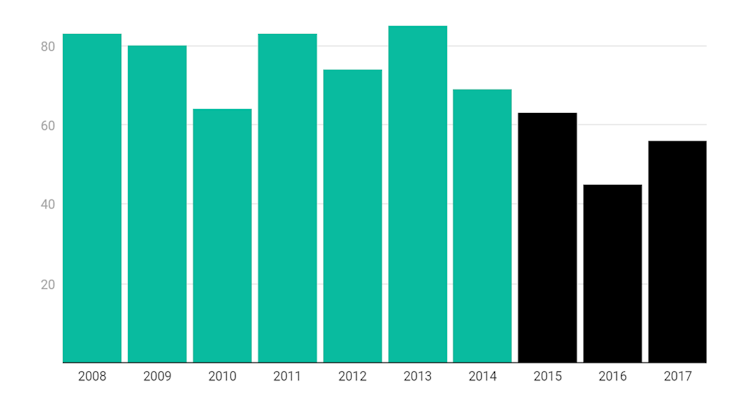

Why 2008 is relevant is because it was the last year there were single-digit trades involving players.

There’s been no fewer than 15 since – peaking at 33 in 2018 – as the AFL player movement system has significantly evolved and list management teams have become more sophisticated.

The decade from 2008 also serves as the basis of the research for this story.

The cut-off season was 2017, because it gives players who were traded in that year up to three campaigns to prove their worth.

Seven of the 25 were gone before this year started. Another six retired or were delisted at season’s end, while Essendon dasher and ex-Sun Adam Saad has requested a trade to Carlton.

Matthew Kennedy and Brendon Ah Chee remain without a contract for next year as well.

That means as few as nine footballers who featured in the 2017 Trade Period could still be kicking a Sherrin at the highest level four years later.

Only five of the original 25 were older than 26 at the time of their trade, too.

Hayden Crozier is the sole certain list survivor who was acquired with a highest draft pick outside the second round. Ah Chee would join him if he receives a fourth-straight one-year deal.

RELATED: The Stats And Facts: Just How Unfair Is AFL Free Agency?

On the flip side, Jake Lever, Devon Smith, Charlie Cameron and Lachie Weller cost their new clubs at least one first-round draft pick to secure their services.

Every year there is talk of how one club stole a march on another, yet more often than not the trade valuation is a good indication of the player’s quality, the risk involved and what is to come.

The 2008 and 2017 Trade Periods are representative of the decade in question, as evidenced below.

2008-2017 Trade Periods

| Draft picks | Nine games or fewer | 10-19 games | 20-29 games | 30-49 games | 50-99 games | 100+ games | Total |

| Top-10 | N/A | N/A | N/A | 2 | 4 | N/A | 6 |

| 11-19 | 3 | 3 | N/A | 2 | 13 | N/A | 21 |

| 20-29 | N/A | 3 | 4 | 3 | 15 | 4 | 29 |

| 30-39 | 6 | 4 | 2 | 7 | 6 | 6 | 31 |

| 40-49 | 5 | 2 | 1 | 8 | 10 | 3 | 29 |

| 50 | 23 | 8 | 14 | 4 | 4 | 1 | 54 |

* Games tally is post-trade and some are ongoing, while the draft pick is the highest in the deal

** Excluded: Three- or four-way trades, when a footballer was traded for another player (with or without picks), multiple players were traded, or when each club swapped a first-round selection

Interestingly, the highest number of traded players to reach the 100-game milestone within the criteria and in this period comes from the 30-39 pick category.

Hawks-turned-Swans Josh Kennedy and Ben McGlynn would’ve swelled that total further, but arrived in the same trade, so didn’t qualify under the criteria used.

However, there are more misses in that bracket. In fact, the top-end production is all that separates it from the 40-49 group.

The guidelines also excluded the deals for Patrick Dangerfield, Zach Tuohy, Dayne Beams, Ben McEvoy, Tom Boyd and others, given it would be too hard to equate a player’s value to a draft pick.

RELATED: Stats Insider's In-House Shot Charting provides a different way of seeing the game

What the table above resoundingly tells us is if a club is willing to part with only a pick in the 50s, then the likelihood of that player becoming a senior regular is miniscule.

List managers’ increased savviness in trading coincides with the AFL enabling clubs to swap future draft picks – one year in advance – from 2015.

That’s resulted in considerably more complicated trades, in part designed to alleviate the risk of ‘losing’ the trade.

This is illustrated in the increased number of draft picks the club trading the player now asks for.

For this purpose, a deal is not included in the data if there are multiple footballers involved or a player is part of the compensation.

The best bang for buck from a positional perspective appears to be from ruckmen.

Twenty-five genuine ruckmen switched clubs a combined 27 times via trade between 2008 and 2017, including two deals apiece for Shane Mumford and Jon Giles.

The average games played post-trade for that group is 57.7, with 16 of those big men – counting Mumford twice – appearing at least 50 times.

That’s despite only Ben McEvoy, Paddy Ryder, Darren Jolly and Tom Hickey being acquired with picks inside the top 20.

What’s the moral here? Trading for value can be a crapshoot – and there’s no guarantee of what you’ll get even when a club invests in experienced and proven talent.

Think Brett Deledio, Andrew Lovett, Chris Yarran and Harley Bennell.

So while there’s plenty of excitement among fanbases at this time of year, the numbers tell a sobering tale that should temper expectations.

Did you enjoy this article? Join our free mailing list to get the best content delivered straight to your inbox, or join the conversation by leaving a comment below or on the Stats Insider Twitter or Facebook page.